In this Guide for Financial Managers, you will discover what a financial manager is, why they are important, and the history of financial managers. You will read about the educational and preparatory process in becoming a professional financial manager. Also, you will learn about future trends of financial managers and the effects of Covid-19 on the position.

What is a Financial Manager?

There is the saying, “money isn’t everything,” but it sure does hold a lot of power. It is an essential commodity in our lives and the functioning of our economy and society. Everyone deals with money on a personal level, professional level, or both. A business cannot operate without it. Someone with the knowledge and skills to efficiently and effectively manage the finances of a company is an esteemed asset to its success. So, what exactly does a financial manager do?

It is easy to say that a financial manager is one who manages finances. But let’s dig a little deeper. What is finance? It involves activities regarding the study, creation, acquirement, and management of money for individuals, businesses, organizations, and governments. Finances are associated with banking, forecasting, budgeting, credit, capital markets, debt, and lending. In business, the main areas of finance are investments, corporate finance, international finance, and financial markets and institutions. Most companies and organizations handle large amounts of money and need to be able to manage it properly. Therefore, the job of a financial manager is essential.

A financial manager is not to be mistaken with a financial advisor. A financial advisor guides and advises clients in matters of finance. A financial manager, however, takes the finances of a business or a person and applies certain management principles, such as organizing, coordinating, planning, and directing. They analyze processes and utilize financial tools to help a company reach its goals and increase profits while overseeing the entire financial health of the company.

Skillset

There is no way to work in the financial industry without being good with numbers. They have to be wired to enjoy, understand, and work well with numbers. To be successful, financial managers must have strong people, collaborative, communication, analytical, organizational, math, technical, and detail-oriented skills. They need to be competent in decision-making, managing risks, accountability, leadership, strategic thinking, managing resources, initiative, teamwork, solving problems, process orientation, prioritizing tasks, and self-motivation.

Personality

According to the Holland Codes, a financial manager typically carries the traits of an Enterprising/Conventional personality. This type of person likes working with people, is influential, persuasive, intellectual, enthusiastic, investigative, dominant, motivational, and adventurous, and exudes confidence, ambition, and assertiveness. All of these traits are combined with being organizational, reliable, and accurate. They thrive in an environment where they can lead others, initiate and complete projects, make lots of decisions, take risks, and manage activities.

Duties

A financial manager works full-time in comfortable offices, and, typically, 50-60 hours a week. A lot of their job is gathering data from other departments within the company, like sales, purchasing, distribution, and trading. They also present to and advise senior management, make financial recommendations, and assist in decision-making. They are responsible for reducing costs, maximizing working capital, maintaining compliance with laws and regulations, monitoring financial details, following the company’s code of conduct, navigating strategies for long-term financial goals, estimating fund requirements, directing investment activities, enforcing financial policies, and helping company growth.

Specific tasks for financial managers include:

- Data analysis and profitability analysis

- Budget and resource allocation

- Tax and financial planning

- Analyze market trends and the financial performance of the company

- Cost accounting and profit projections

- Produce and reviewing financial reports

- Maintain cash-flow

- Stay current on the global markets

- Prepare financial and cash-flow statements

- Read up on current industry research

- Remain current on legal requirements

- Treasury and project management

- Develop and execute a financial strategy

- Formation of the capital structure

- Planning of health and safety procedures

- Manage a team of employees

As a financial manager becomes more experienced and knowledgeable in all of the different operations within a company, they can advance to a management position. Within this position, they would have increased responsibility, more sophisticated tasks, and oversee a larger group of employees. As those who are wired to succeed as a financial manager tend to enjoy power, money, and being in charge, they can find career satisfaction in a management position.

For some visual descriptions, check out these two videos on financial management careers and daily responsibilities of a financial manager.

Types of Financial Managers

With the vast array of departments and duties within a company, especially large corporations, there are several different types of financial managers working together for the company’s common good. Also, smaller businesses may only need one or two financial managers that focus on several areas at once. Let’s explore, in more detail, what these specific financial managers do.

- Chief Financial Officer (CFO) – A CFO is the top executive management position responsible for overseeing and managing the entire company’s finances.

- Credit Managers – A credit manager oversees all business that involves credit. They develop credit scoring models to predict risks, set credit-rating standards, approve and reject loans, and enforce past-due collections. Also, they decide credit ceilings, credit limits, acceptable risk, and terms of payment.

- Controllers – A controller is responsible for ensuring the company is financially compliant and follows all government regulations. They will produce, prepare, and manage accurate financial and accounting reports and statements, including balance sheets and income statements. A controller is often in a leadership position, overseeing teams, and monitoring the entire accounting process.

- Cash Managers – A cash manager is responsible for the business financial transactions of a company. They analyze and monitor budgets, financial reports, cash flow, and the lack and surplus of funds to determine when the company needs a loan and when they can invest.

- Insurance Managers – An insurance manager evaluates risk and determines what insurance a company needs to purchase to protect against risk or lawsuits.

- Treasurer – A treasurer manages a company’s financial affairs, including cash management and procurement goals, funding, banking, sales, planning, budgeting, investments, acquisitions, and fundraising.

- Risk Managers – A risk manager utilizes strategies to control a company’s financial risk. They identify potential hazards and risks and put preventative measures in place to limit financial loss and damage.

- Entrepreneurs – A financial manager who has enough knowledge and experience can choose to go out on their own and build a consulting firm.

Types of Employers

Due to the fact that they manage the finances, financial managers are essential in a vast array of industries and environments. The success of almost every firm, business organization, and government agency requires a financial manager’s expertise and abilities. An excellent place for a beginning financial manager is an entry-level position at a bank or a large company. You will find financial managers in private and public sectors, employed by financial institutions, charities, multinational corporations, investment firms, universities, retailers, insurance companies, manufacturing companies, and a multitude of businesses.

In 2018, there were 653,600 positions filled by financial managers, according to the U.S. Bureau of Labor Statistics. The largest employers were in the finance and insurance industries. The second-largest were in professional, scientific, and technical services, and the next few in management of companies and enterprises, government, and manufacturing.

Pay

We have discussed what financial managers do with other people’s money, so let’s now talk about the amount of money these people make for themselves. A financial manager can make an excellent living. It is a competitive job market and ranks #16 best paying jobs of all jobs. Considering their goal is to make sure a company makes as much money as possible and loses as little money as possible, financial managers are highly regarded, prioritized, and well taken care of by their employers.

Over the last couple of years, the median salary for financial managers ranged from $114,210 to $129,890 a year. As the U.S. Bureau of Labor Statistics breaks down the median salary for each top employer, they find that professional, scientific, and technical services pay the highest salary at $152,810. Then there is the management of companies and enterprises at $145,280, manufacturing at $130,900, finance and insurance at $125,600, and government at $114,250.

U.S. News & World Report compiled the best-paying cities and states for financial managers. The cities with the highest salary are New York ($208,670), Bridgeport ($204,690), San Francisco ($184,350), San Jose ($184,340), and Boulder ($174,360). The states with the highest salaries are New York, New Jersey, Connecticut, Delaware, and the District of Columbia, ranging from $166,710 in D.C. to $210,510 in New York.

History of Financial Managers

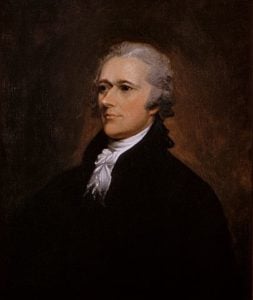

From simple bartering systems to the current global banking system, money and the importance of it has been around for the past 3,000 years. However, the term “finance” and the idea of “financial management” has only really evolved over the past 230 years. We can begin with the “founding father of finance,” Alexander Hamilton, who was America’s first Secretary of the Treasury from 1790 – 1795. He is responsible for creating or influencing the basic elements that comprise the world of finance like securities markets, the stabilization of financial markets, the consolidation of the national debt, and the Bank of the U.S., the first central bank. Hamilton also helped give the dollar its value and wrote the first Report on Public Credit.

Over the next century, what we know of financial management was mixed into and a part of economics as a whole. At the start of the 1900s, financial management began a life of its own and became a specific field of study. Let’s take a look at how financial management and the position of a financial manager has evolved over the past century in three phases.

The 1900s – 1940s: The Traditional Phase

Compared to what we know of current financial managers’ duties and responsibilities, we can easily describe the role of financial managers in the early 1900s as simple and somewhat one-dimensional. The Second Industrial Revolution brought about more rapid changes and advancements than ever before, and arguably since. Mass production and long-distance transportation created significant opportunities and, along with it, an array of business challenges, including expansion, enterprises, liquidation, reorganization, and mergers. In finding solutions to these challenges, this phase brought about a strong foundation for financial management.

The 1940s – 1950s: The Transitional Phase

As the concepts of banking continued to rise and morph during this transitional phase, financial managers faced new challenges, while still managing old ones. Now, they had to navigate the daily operations, like monetary planning, analysis, and control, while figuring out how to manage working capital. Within this time frame, the very first credit card system was created by John Biggins called the Charge-It, which allowed those close to the bank to charge their purchases. In 1950, the first independent card company, the Diners’ Club, was formed by McNamara and Schneider. It allowed people to charge credit at any store that participated in the program.

The mid-1950s – Present: The Modern Phase

As you can see, the transitional phase was short. With the rapid changes happening all around, the breadth of responsibilities for financial managers widened and became more defined as the importance of the role increased. Some of the changes included globalization, emerging markets, technological advances, business practices, rapid development, and the integration of financial practices with economic theories and quantitative methods. The ways to analyze finances multiplied and became more sophisticated to reach new goals. Some of the topics, ideas, and theories developed during this time include financial modeling, capital structure theory, capital budgeting, arbitrage pricing theories, dividend policy, the efficient market investment theory, and business valuation models.

The role of the financial manager evolved into what we know today. Thirty years ago, financial managers were more authoritarian, only used historical data, were the “guardians of the company,” and had to “defend their decisions” when presenting to management. Today, financial managers are more consultative, have leadership and teamwork skills, analyze past and present data and estimations of future changes when making decisions, and clearly explain their decisions in an effort to persuade management.

Preparation for Financial Managers

Is it an easy process in becoming a financial manager? Can someone wake up one day and be ready to manage the finances for a large corporation? Definitely not. It takes a good solid education and years of training and experience to succeed as a financial manager.

Education

A bachelor’s degree in finance, business administration, economics, or accounting builds a good infrastructure and is the minimum educational requirement for financial managers. If an undergraduate pursues a degree in business administration, it would be essential to include an area of concentration in finance, accounting, or economics. These degrees allow students to enter an entry-level job in finance and pursue a graduate degree. Most financial manager positions, especially upper management, require a master’s degree in finance, business administration, or economics.

Although it is not required for financial managers to acquire professional certifications, it is highly encouraged and respected. They help educate you further and open professional opportunities you may not have access to without them. One of the certifications that can benefit financial managers is the Chartered Financial Analyst (CFA) Certification for investment professionals, offered by the CFA Institute. Other great certifications include the Certified Treasury Professional (CTP) credential, and the Certified Corporate Financial Planning Analysis Professional (FP&A) credential, both provided by The Association for Financial Professionals.

Professional Development

While students are working toward their degree, whether in undergraduate or graduate studies, they can pursue internships that provide an incredible amount of hands-on experience and training. There are numerous internships out there for those studying to become financial managers, including the Financial Management Internship Program offered by The Office of the Comptroller of the Currency within the U.S. Department of Treasury. Indeed.com lists current internships with Northwestern Mutual, PNC Financial Services Group, and JPMorgan Chase Bank.

It takes years of professional experience to become a financial manager, typically five or more years. This position can be obtained by working in the financial world as an accountant, financial consultant, financial analyst, loan officer, auditor, securities sales agent, or similar. Some companies will offer on-site management training to those individuals that qualify and desire a position in financial management.

Another great way to develop professionally, while giving of your time and talents, is through volunteering. It is important to volunteer with an organization or an event that aligns with your passions, personal interests, and professional goals. Financial management students can help low-income households prepare their taxes for free through income tax assistance programs like VITA. They can work on real investment deals with real clients through the largest student-run venture capital firm: The University Venture Fund. Students and professionals can volunteer their knowledge and skills to a local educational institution, serve on a local nonprofit board, or speak at a forum.

Financial managers should highly consider becoming a member of one or more financial associations. They provide training, research, articles, journals, certifications, events, networking, online resources, and a global community for financial professionals. There is the CFA Institute, the Association for Financial Professionals, and the Financial Management Association.

Future Trends of Financial Managers

Financial managers are currently ranked in the top five best business jobs and within the top ten in-demand financial careers. There are estimated to be over 650,000 financial managers in the U.S. The Bureau of Labor and Statistics estimates a 16.0% job increase and over 104,000 financial manager positions to become available between 2018 and 2028. This is a faster growth rate than all other occupations on average.

The demand for financial managers increases alongside the transformation of the financial world and the rapid technological advances all around us. To successfully prepare for what is to come, we have to be aware of the emerging trends affecting and will affect the future of financial management. Here is a list of some of the many trends that are shaping the future of finance.

- Digitization and digital technologies – Digital shifts are happening and creating the need for digital competency and digital transformation.

- Decision-ready data

- Scalable centralized finance analytics

- On-demand reporting

- A new era for Enterprise Resource Planning (ERP)

- Increase in Big Data

- Cybersecurity

- FinTech companies compete with banks and credit unions providing third-party financial providers

- The revolution of intelligence platforms like artificial intelligence, machine learning, and blockchain

- The utilization of global business services

Financial Managers and COVID-19

The COVID-19 pandemic is global and has dramatically impacted the entire world financially. People have lost jobs and lost money. Therefore, they are not spending money, which has caused the economy to weaken. Losses are becoming higher than the profits and some businesses are shutting down. Financial managers are facing extreme challenges as they navigate the impact this coronavirus has had on their organizations. Luckily, financial managers have been trained to plan for the uncertainty of times and can work hard to find solutions for their company’s survival during this time.

For more information on how financial professionals can help during this time, check out this article on Planning for uncertainty: Performance management under COVID-19. KPMG also has some great resources on the implications of COVID-19 for Banking and Capital Markets, Insurers, and Asset Management, and insights into COVID-19 and Financial Reporting and Emerging Risks.

Next Steps

As you have seen throughout this Guide for Financial Managers, financial managers are a critical asset to the success of large businesses and corporations. They have been essential for over 100 years and continue to grow in importance and demand. Do you enjoy working with numbers, money, data, and leading a team of people? Is this the career for you?

Spend some time listening to finance managers explaining their personal experience and see if this career interests you:

- A Day in the Life of a Finance Manager at eBay

- A Day in the Life of a Global Finance Manager

- Being a Finance Manager at Sephora

Take this quick and free test to see if your personality matches that of a financial manager. And if you are wondering if you might be wired for a position as a financial manager, take this free career test to find out.

Related Resources

Online Finance MBA Ranking

Online Master’s in Finance Management

Free Resources for Financial Managers

Best Online MBA Programs for Financial Managers

Best Degrees to Become an Financial Manager