The economic landscape is no exception in a world increasingly recognizing the importance of diversity and inclusivity. As our society becomes more attuned to the unique challenges faced by marginalized communities, the spotlight is turning to the vital role of minority entrepreneurs and BIPOC small businesses in driving innovation, job creation, and economic growth. These entrepreneurs bring a wealth of creativity, resilience, and fresh perspectives essential to fostering a diverse and dynamic marketplace and play a pivotal role in building more equitable, inclusive economies.

However, for BIPOC business owners, the path to success is often paved with hurdles beyond the typical trials of entrepreneurship. Historical and systemic barriers, such as limited access to capital, discrimination, and fewer mentorship opportunities, can hinder the growth and sustainability of their enterprises. These disparities highlight the pressing need for dedicated support systems and resources tailored to the unique challenges faced by BIPOC entrepreneurs. By providing access to funding, mentorship programs, and educational initiatives and fostering a supportive ecosystem, we can empower BIPOC entrepreneurs to overcome these obstacles, amplifying their potential and positively impacting the broader economy.

According the Brookings Institution, the underrepresentation of business ownership among Black people is a significant obstacle to a racially inclusive economy in our country. Black ownership represent 2.4% of employer-firm owners despite representing over 14% of the population. These disparities highlight the pressing need for dedicated support systems and resources tailored to the unique challenges faced by BIPOC entrepreneurs.

In this guide, we will delve into the profound importance of these support systems on individual businesses and the broader economic landscape, fostering a more equitable and vibrant entrepreneurial ecosystem for all.

Government Resources

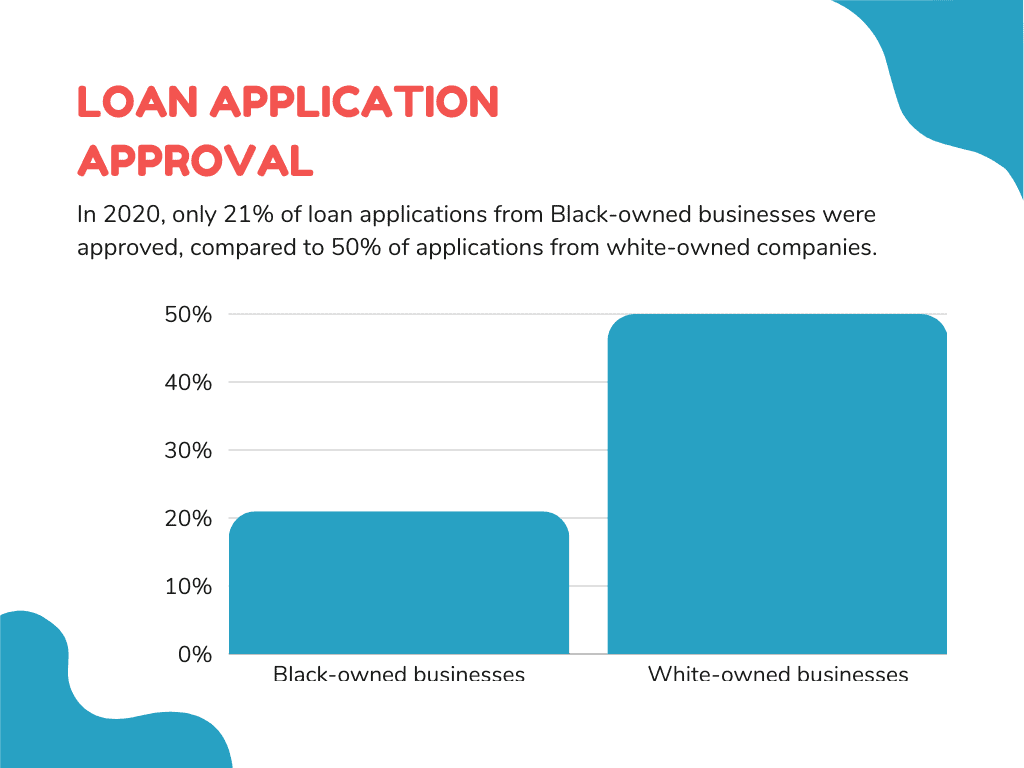

According to a U.S. Small Business Administration (SBA) study, minority-owned firms are less likely to receive traditional financing from banks and other lending institutions. In 2020, only 21% of loan applications from Black-owned businesses were approved, compared to 50% of applications from white-owned companies.

Government resources can help to bridge this gap by providing access to capital, training, and technical assistance. For example, the SBA offers a variety of loan programs designed explicitly for minority-owned companies, such as the 7(a) loan program and the Microloan program. In addition, the SBA provides counseling and training services through its network of Small Business Development Centers (SBDCs) and Women’s Business Centers (WBCs).

Government resources can also help BIPOC businesses to gain access to government contracts. The federal government is the biggest buyer of goods and services in the world, and it has several programs designed to increase the participation of minority-owned businesses in government contracting. For example, the SBA’s 8(a) Business Development program provides contracting assistance to small businesses owned by socially and economically disadvantaged individuals.

The significance of government resources for BIPOC businesses is evident in the data. A study by the Kauffman Foundation found that companies that participated in SBA programs were more likely to survive and grow than those that did not participate. In addition, a study by the Minority Business Development Agency (MBDA) found that MBDA-assisted clients were more likely to increase their sales and create jobs than non-MBDA clients. Here’s a list of governmental agencies that aid BIPOC Businesses.

- Minority Business Development Agency (MBDA): Provides grants, loans, counseling, and training to minority-owned businesses.

- Small Business Administration (SBA): Offers a variety of loans, grants, and counseling services to small businesses, including those owned by minorities.

- Department of Commerce (DOC): Provides access to export markets, trade promotion programs, and business development assistance.

- Department of Agriculture (USDA): Offers loans, grants, and technical assistance to rural businesses, including those owned by minorities.

- Department of Housing and Urban Development (HUD): Gives funding and loans for businesses in economically distressed areas, including those owned by minorities.

- Department of Transportation (DOT): Offers contracting opportunities and technical assistance to businesses in the transportation industry, including those owned by minorities.

- Department of Energy (DOE): Provides grants and loans for businesses that develop and deploy energy-efficient technologies, including those owned by minorities.

- Environmental Protection Agency (EPA): Offers grants and loans for businesses that develop and deploy clean energy technologies, including those owned by minorities.

- National Telecommunications and Information Administration (NTIA): Provides grants and loans for businesses that develop and deploy broadband technologies, including those owned by minorities.

- US Patent and Trademark Office (USPTO): Provides resources and assistance to businesses seeking to protect their intellectual property, including those owned by minorities.

Funding Resources

Finding funding for BIPOC businesses can be challenging, as they often face systemic barriers to access capital. However, several resources are available to help BIPOC business owners find the money they need to start, grow, and succeed.

Government agencies such as the Minority Business Development Agency (MBDA) and the Small Business Administration (SBA) offer a variety of grants, loans, and counseling services specifically for minority-owned businesses. Additionally, several private foundations and non-profit organizations provide funding to BIPOC entrepreneurs.

In addition to traditional funding sources, BIPOC business owners can explore alternative funding options such as crowdfunding, angel investing, and venture capital. Crowdfunding platforms such as Kickstarter and GoFundMe can considerably raise small amounts of capital from many people. Angel investors are individuals who invest their own money in early-stage businesses, while venture capitalists are firms that invest large sums of cash in high-growth companies.

While finding funding can be a challenge, BIPOC entrepreneurs need to persevere. They can see the resources they need to reach their business goals with careful planning and research. Here’s a list of resources!

- Amber Grant: Offers $5,000 grants to Black women-owned businesses every month.

- Black Girl Ventures: Provides grants, training, and mentorship to Black and Brown women entrepreneurs.

- Fearless Fund: Offers grants and support to women of color entrepreneurs building businesses that solve social and environmental problems.

- First Nations Development Institute (FNDI): Provides financial and technical assistance to Native American-owned businesses.

- Google for Startups Black Founders Fund: Offers non-dilutive cash awards, mentorship, and access to Google’s resources to Black-led startups.

- Hello Alice: Provides access to grants, loans, and other resources for women-owned businesses.

- Minority Business Development Agency (MBDA): Provides grants, loans, counseling, and training to minority-owned businesses.

- National Association for the Self-Employed (NASE): Offers a variety of resources and support for self-employed individuals, including grants and loans.

- SCORE: gives free and private business mentoring and counseling to entrepreneurs.

- Small Business Administration (SBA): Offers a variety of loans, grants, and counseling services to small businesses, including those owned by minorities.

Local Resources

Please be advised that every state has specific resources for BIPOC businesses. This list is specifically for the state of Massachusetts. Use this as a reference point to find your own local resources.

- Massachusetts Small Business Development Center (MSBDC): The MSBDC provides free and confidential business counseling and training services to small businesses throughout Massachusetts. They have a team of experienced business advisors who can help BIPOC entrepreneurs start and grow their businesses.

- Minority Business Development Agency (MBDA) Business Center in Boston: The MBDA Business Center in Boston provides various services to support the growth and success of minority-owned businesses in Massachusetts. These services include business counseling, training, and access to capital.

- Black Economic Council of Massachusetts (BECMA): BECMA is a non-profit organization that advocates for the economic empowerment of Black businesses and communities in Massachusetts. They provide various services to support BIPOC entrepreneurs, including business counseling, training, and networking opportunities.

- New England Minority Supplier Development Council (NEMSDC): NEMSDC is a non-profit organization that helps connect minority-owned businesses with corporate buyers. They provide various services to support BIPOC entrepreneurs, including business certification, matchmaking events, and training.

- Massachusetts Minority Business Alliance (MMBA): MMBA is a non-profit organization that provides various services to support the growth and success of BIPOC businesses in Massachusetts. These services include business counseling, training, and access to capital.

- Boston LatinX Business Association (BLBA): A non-profit group called BLBA promotes the expansion and success of Latinx-run businesses in Boston. They provide various services to support BIPOC entrepreneurs, including business counseling, training, and networking opportunities.

- Asian American Business Development Center (AABDC): AABDC is a non-profit organization that offers services to help Asian American-owned businesses in Massachusetts expand and flourish. These services include business counseling, training, and access to capital.

- Massachusetts Asian American Commission (MAAC): MAAC is a state agency that promotes the economic development of Asian American-owned businesses in Massachusetts. They provide various services to support BIPOC entrepreneurs, including business counseling, training, and access to capital.

- Massachusetts Office of Minority and Women Business Assistance (OMWBA): OMWBA is a state agency that provides services to support the growth and development of minority-owned and women-owned businesses in Massachusetts. These services include business counseling, training, and access to capital.

- Massachusetts Minority and Women Business Enterprise Certification Program (M/WBE): The M/WBE Certification Program is a state program that certifies minority-owned and women-owned businesses as eligible to participate in state contracting opportunities.

Scholarly or other Articles Related to Being a BIPOC Business Owners

- The Racial Wealth Gap: Its Origins and Implications for Future Public Policy by Thomas Shapiro – The historical and current causes of the racial wealth disparity in the US are examined in this book. The author provides evidence that the racial wealth gap is not simply a product of individual choices but is the result of systemic racism that has denied Black Americans the opportunity to accumulate wealth. The book also discusses the implications of the racial wealth gap for future public policy.

- Black Business Ownership: Past, Present, and Future by David G. Blanchflower and William J. Collins – This book provides a comprehensive overview of the history of Black business ownership in the United States. The authors talk about the difficulties and chances experienced by Black business owners and the effects of Black companies on the economy. The book also includes case studies of successful Black businesses.

- The State of Black Capitalism by the National Black Business Council – This annual report provides data and analysis on the state of Black-owned businesses in the United States. The paper covers a wide range of subjects, including government contracting, access to credit, and the effect of COVID-19 on Black-owned enterprises.

- The Color of Wealth: The Economic Impact of the Racial Wealth Gap by Dorothy A. Brown – This book examines the economic impact of the racial wealth gap on individuals, families, and communities. The author argues that the racial wealth gap is a significant obstacle to economic mobility and significantly impacts the economy.

- The Case for Reparations by Ta-Nehisi Coates claims that to make up for the effects of slavery and Jim Crow; the United States owes reparations to Black people. The author gives a historical breakdown of the harms that slavery and Jim Crow caused to Black Americans and makes the case that reparations are required to remedy the continued economic and social disadvantages that Black Americans experience.

Online resources

Here are some great online resources for BIPOC businesses:

Networking and Mentorship Groups:

- JEDI Collaborative: A community for BIPOC entrepreneurs and allies to connect, collaborate, and learn from each other.

- Project Potluck: A platform that connects BIPOC food entrepreneurs with mentors, resources, and opportunities.

Accelerators and Business Resources:

- Latina Entrepreneur Academy: A program that provides training, mentorship, and funding to Latina entrepreneurs.

- MBDA: The US Department of Commerce’s Minority Business Development Agency provides various services to support the growth and development of minority-owned businesses.

- New Voices Foundation: A non-profit that provides grants, training, and mentorship to women of color entrepreneurs.

- National Minority Supplier Development Council (NMSDC): A certification organization that helps connect minority-owned businesses with corporate buyers.

Lending, Banking, and Investing options:

- Accion: A non-profit that provides financial services to underserved entrepreneurs.

- Aspen Capital Fund: A venture capital firm that invests in early-stage companies led by diverse founders.

- Kapor Capital: A venture capital firm that funds businesses attempting to narrow the wealth gap across races.

Grants:

- The Coalition to Back Black Businesses: A coalition of organizations committed to providing $1 billion in loans and grants to Black-owned businesses.

- Comcast RISE Investment Fund: A program that provides capital to small businesses owned by people of color.

- Empower Project: A program that provides grants to women-owned companies in the food and beverage industry.

- Food and Beverage Investment Fund: A fund that gives to Black, Indigenous, and People of Color (BIPOC)-owned food and beverage businesses.

- Lashify’s Black-owned Beauty Brand Grant: A grant program funding Black-owned beauty brands.

- Michigan Good Food Fund: A fund that provides grants to food and agriculture businesses in Michigan, focusing on BIPOC-owned companies.

- Rebuild the Block: A program that provides grants and technical assistance to Black-owned businesses in the hospitality industry.

- Scale-Up Pitch Challenge: A pitch competition that offers grants for BIPOC-owned enterprises.

- SoGal Foundation Black Founder Startup Grant: A grant program that provides funding to Black women founders.

Tips for BIPOC Business Owners

- Build a strong network of support. As a BIPOC business owner, having a solid support network is essential to help you manage the challenges of starting and growing a business. This network can include mentors, other entrepreneurs, industry experts, and community leaders.

- Seek out funding and resources specifically for BIPOC businesses. Several organizations provide funding and resources specifically for BIPOC businesses. These organizations can give you access to capital, training, and other support services.

- Get involved in your community. Being involved in your community can help you build relationships with potential customers and partners. It can also help you raise awareness of your business.

- Market your business effectively. It is crucial to market your business effectively to reach your target audience. There are many ways to market your business, such as through social media, online advertising, and public relations.

- Be prepared to face challenges. Starting and growing a business is always challenging but even harder for BIPOC entrepreneurs. Be ready to face challenges such as discrimination, lack of access to capital, and negative stereotypes.

- Don’t give up. Starting and growing a business is a lot of work but also gratifying. Keep pursuing your dreams of owning a successful business.

- Celebrate your successes. Along the process, it’s crucial to recognize your accomplishments. You’ll be inspired to keep going forward as a result.

- Pay it forward. Once you succeed, please pay it forward by helping other BIPOC entrepreneurs. This can be done by mentoring other entrepreneurs, funding, or offering encouragement.

- Be a role model. As a BIPOC business owner, you are a role model for other aspiring entrepreneurs. Be the role model you want to see in the world.

- Be proud of who you are and your identity as a BIPOC business owner. Your unique perspective and experiences can make you a more successful entrepreneur.

Online Tools for BIPOC Business Owners

- Quickbooks Online: Accounting software that helps track income and expenses, manage invoices and payments, and generate reports.

- FreshBooks: Cloud-based accounting software helps small businesses create invoices, track expenses, and manage payments.

- Wave Accounting: Free accounting software that offers invoicing, expense tracking, and financial reporting.

- Zoho Books: Online accounting software helps businesses manage finances, track inventory, and collaborate with accountants.

- Xero: Cloud-based accounting software that helps businesses manage finances, track inventory, and collaborate with accountants.

- Gusto: Payroll and HR software that helps businesses automate payroll, manage benefits, and comply with regulations.

- BambooHR: HR software that helps businesses manage team member records, track time and attendance, and onboard new hires.

- Zenefits: HR software helps businesses manage team member benefits, payroll, and compliance.

- Namely: HR software that helps businesses manage payroll, benefits, time and attendance, and performance reviews.

- Rippling: HR software that helps businesses manage team member onboarding, offboarding, and compliance.

Resources for Allies to Support BIPOC Businesses

- Shop at BIPOC-owned businesses. This is one of the most direct ways to support BIPOC businesses. When you shop at a BIPOC-owned business, you are putting your money into the hands of someone likely to reinvest it back into the community.

- Promote BIPOC-owned businesses on social media. Share their posts, like their pages, and leave positive reviews. This can increase their visibility and bring in new customers.

- Leave positive reviews for BIPOC-owned businesses. Reviews can help boost a business’s ranking in SEO results pages (SERPs), making it more likely that people will find them.

- Refer your friends and family to BIPOC-owned businesses. Word-of-mouth is still one of the most effective forms of advertising.

- Invest in BIPOC-owned businesses. There are several ways to invest in BIPOC-owned companies, such as through crowdfunding platforms or angel investing.

- Volunteer your time or skills to BIPOC-owned businesses. This could involve anything from helping out with marketing and social media to providing professional services.

- Speak out against racism and discrimination. This can aid in creating a more supportive environment for BIPOC businesses.

- Educate yourself about the challenges faced by BIPOC businesses. The more you know, the better equipped you will be to support them.

- Support organizations that are working to support BIPOC businesses. These organizations can provide BIPOC businesses with access to resources, training, and networking opportunities.

- Be an ally to BIPOC business owners. This means listening to their concerns, offering support, and challenging discrimination.

Related Resources:

Best Business Schools for People of Color

Best Historically Black Colleges and Universities

Representation of Black Voices in the Classroom